Thinking about an Adjustable-Rate Mortgage? Read This First.

Beth Helvey May 26, 2025

Beth Helvey May 26, 2025

If you’ve been house hunting lately, you’ve probably felt the sting of today’s mortgage rates. And it’s because of those rates and rising home prices that many homebuyers are starting to explore other types of loans to make the numbers work. And one option that’s gaining popularity? Adjustable-rate mortgages (ARMs).

If you remember the crash in 2008, this may bring up some concerns. But don’t worry. Today’s ARMs aren’t the same. Here’s why.

Back then, some buyers were given loans they couldn’t afford after the rates adjusted. But now, lenders are more cautious, and they evaluate whether you could still afford the loan if your rate increases. So, don’t assume the return of ARMs means another crash. Right now, it just shows some buyers are looking for creative solutions when affordability is tough.

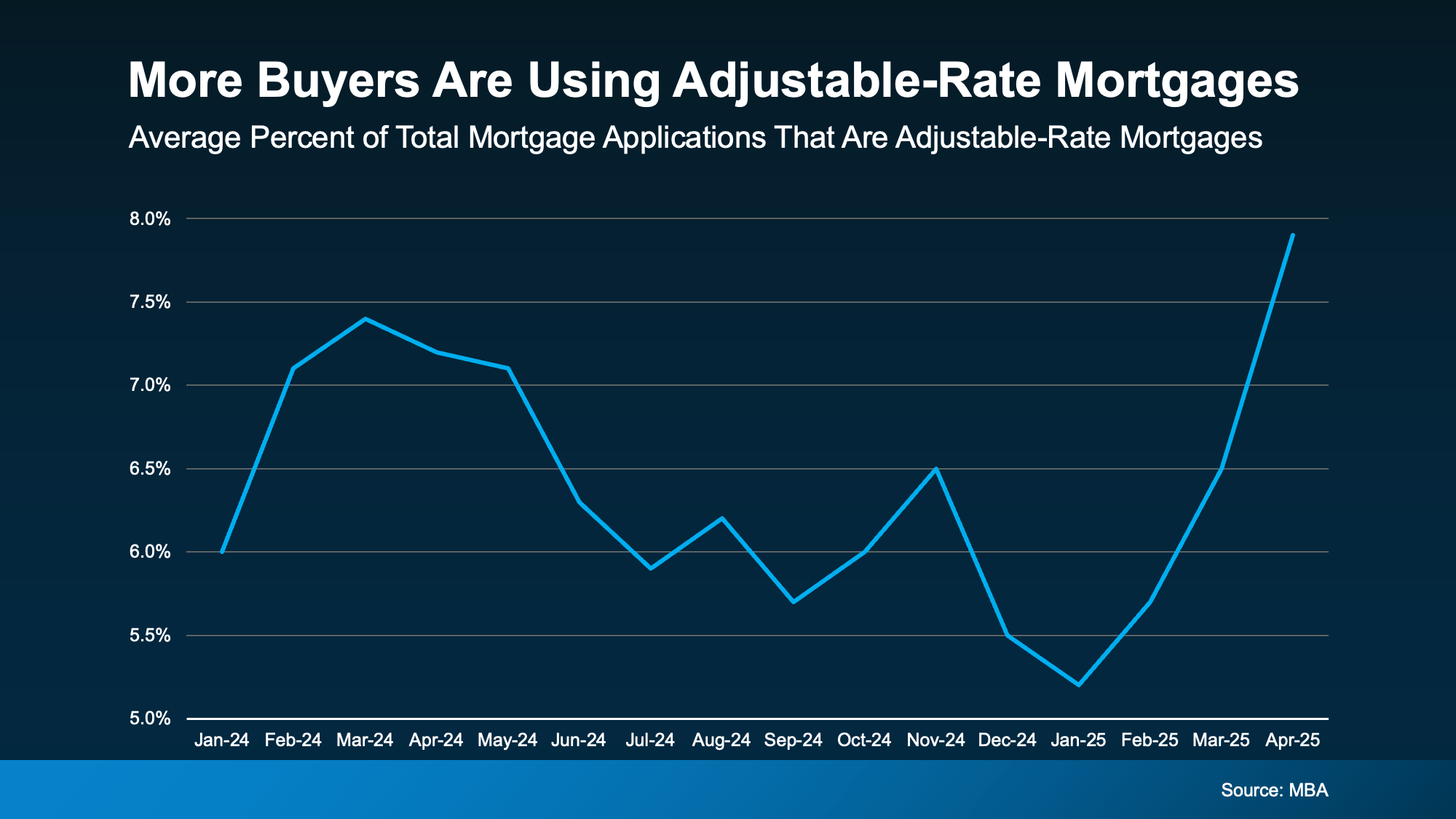

You can see the recent trend in this data from the Mortgage Bankers Association (MBA). More people are opting for ARMs right now (see graph below):

And while ARMs aren’t right for everyone, in certain situations they do have their benefits.

And while ARMs aren’t right for everyone, in certain situations they do have their benefits.

Here’s how Business Insider explains the main difference between a fixed-rate mortgage and an adjustable-rate mortgage:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You'll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they've gone down, your payment will decrease.”

Of course, things like taxes or homeowner’s insurance can still have an impact on a fixed-rate loan, but the baseline of your mortgage payment doesn’t change much. Adjustable-rate mortgages don't work the same way.

Here’s a little more information on why some buyers are giving ARMs another look. They offer some pretty appealing upsides, like a lower initial rate. As Business Insider explains:

"Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan."

On the flip side, just remember, if you have an ARM, your rate will change over time. As Barron’s explains there’s the potential for higher costs later:

"Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up."

So, while the upfront savings can be helpful now, you'll want to think through what could happen if you're still in that home when your initial rate ends. Because while projections show rates are expected to ease a bit over the next year or two, no forecast is guaranteed.

That’s why it’s essential to talk with your lender and financial advisor about all your options and whether an ARM aligns with your financial goals and your comfort with risk.

For the right buyer, ARMs can offer some big advantages. But they’re not one-size-fits-all. The key is understanding how they work, weighing the pros and cons, and thinking through if they’d be something that would work for you financially. And that’s why you need to talk to a trusted lender and financial advisor before you make any decisions.

Do You Need Flood Insurance?

Shifting your furniture may shift how you think, feel, and even behave. Clinical psychologists and interior designers explain why

Hidden Gem is the Color of the Year

I’d love to hear from you! Whether you’re buying, selling, or just exploring your options, I'm here to provide answers, insights, and the support you need. Contact me and start planning your next move.