Is It Better To Rent or Buy a Home?

Beth Helvey June 2, 2025

Beth Helvey June 2, 2025

You’ve probably asked yourself lately: Is it even worth trying to buy a home right now?

With high home prices and stubborn mortgage rates, renting can seem like the safer choice right now. Or maybe your only choice. That’s a very real feeling. And perhaps buying today isn’t your best move; it’s not for everyone right away. You should only buy a home when you’re ready and able to do it, and if the timing is right for you.

But here’s the thing you need to know about renting.

While it may feel like a safer bet today – and in some areas might even be less expensive month-to-month than owning – it can really cost you more over time.

In fact, a recent Bank of America survey found that 70% of aspiring homeowners worry about what long-term renting means for their future. And they’re not wrong.

Owning a home may seem way out of reach, but if you make a plan now and steadily work toward it, homeownership comes with serious long-term financial benefits.

Buying a home isn’t just about having a place to live – it’s a step toward building your future wealth.

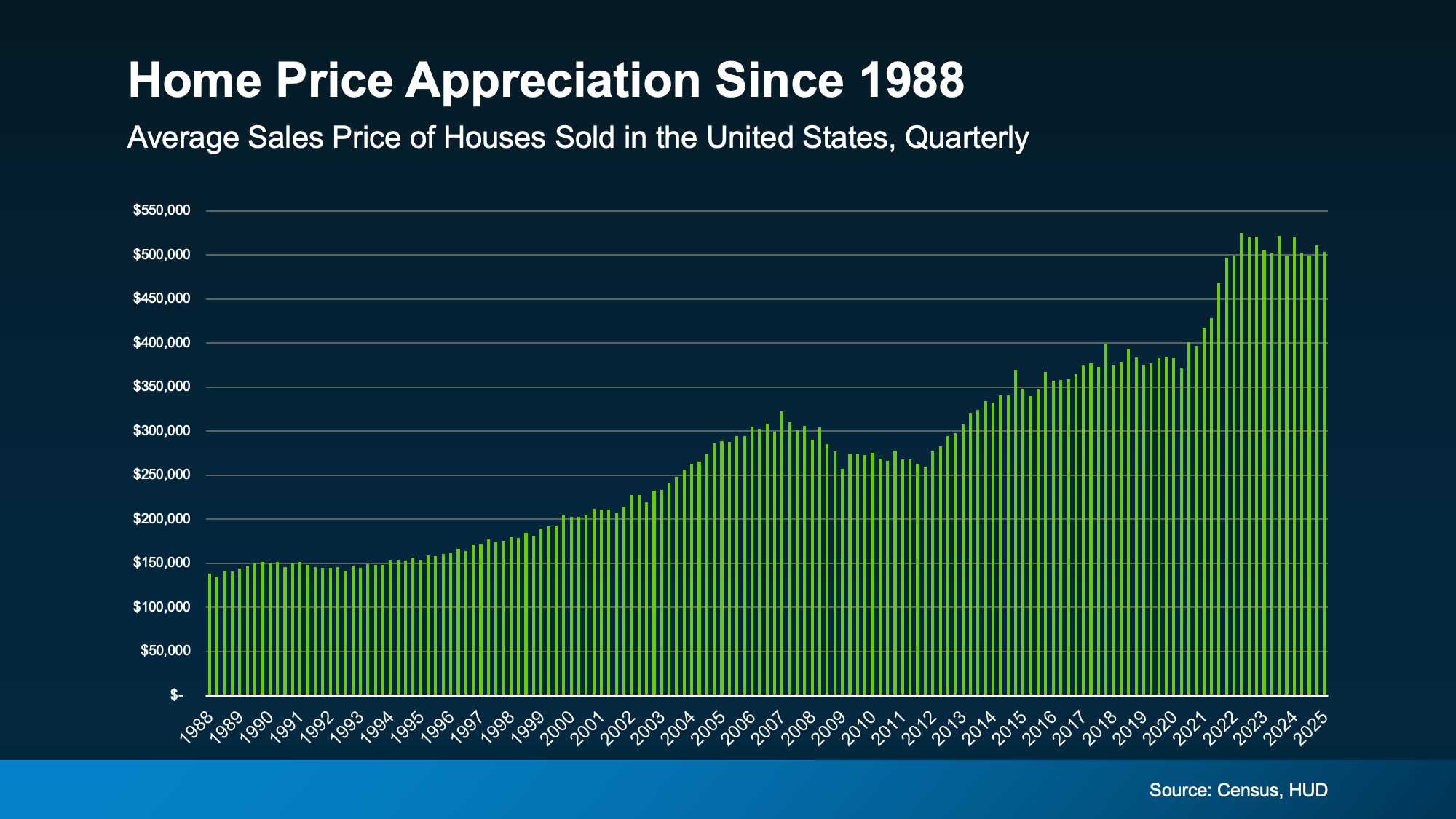

Why? Home prices typically rise over time, which means the longer you wait, the more expensive it is to buy. And even in some markets where home prices are softening today, the overall long-term trend speaks for itself (see graph below):

And as home values rise, so does your equity when you’re a homeowner. That’s the difference between what your home is worth and what you owe. So, with every mortgage payment, that equity grows. Over time, that becomes part of your net worth.

And as home values rise, so does your equity when you’re a homeowner. That’s the difference between what your home is worth and what you owe. So, with every mortgage payment, that equity grows. Over time, that becomes part of your net worth.

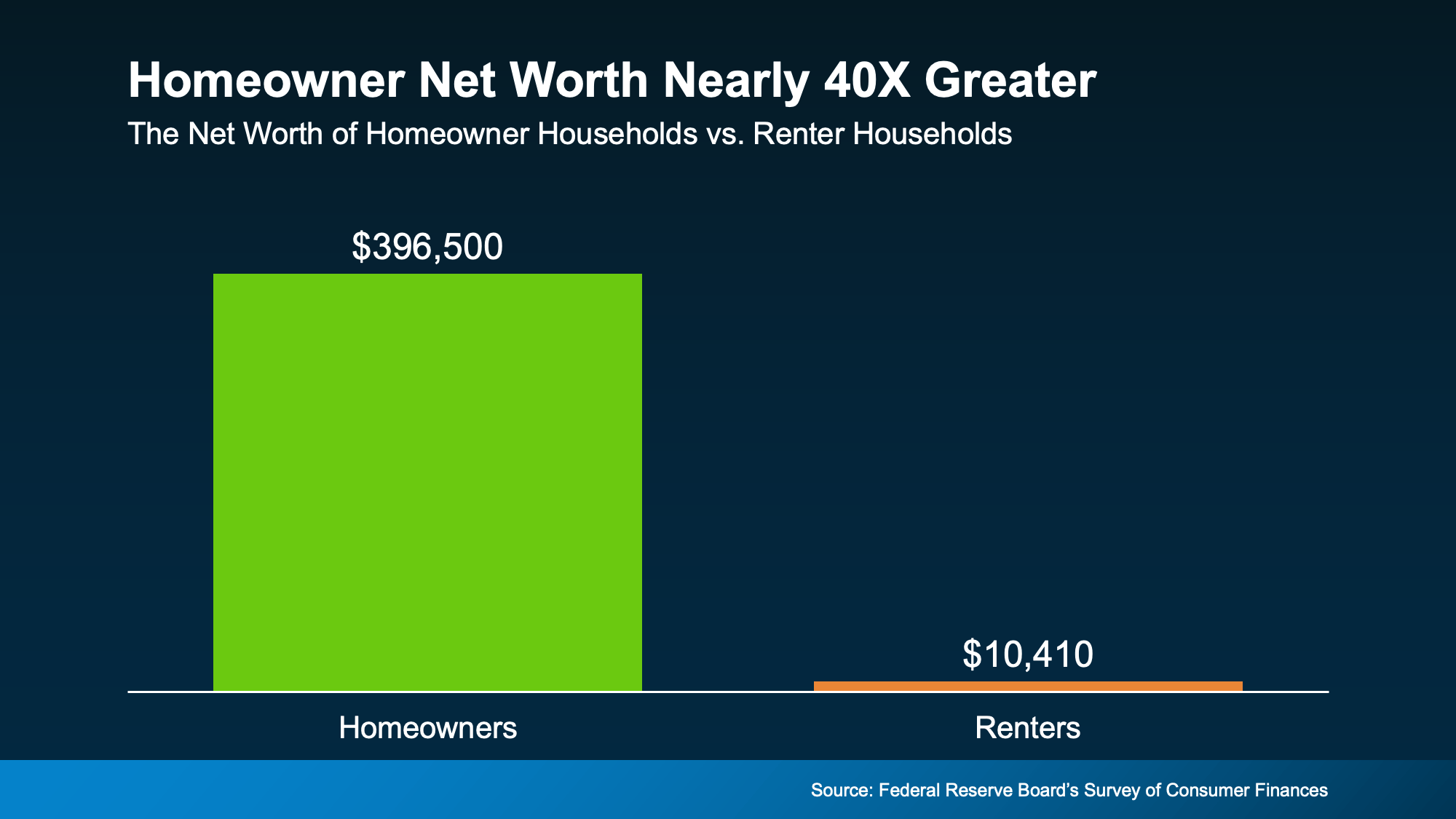

Today, the average homeowner’s net worth is nearly 40X greater than that of a renter. That’s a shocking difference, and the dollars in the visual below don’t lie (see graph below):

And it’s one of the big reasons why Forbes says:

And it’s one of the big reasons why Forbes says:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

So, short-term, why does renting feel like a simpler choice? Lower monthly payments, less responsibility, no strings attached. But long-term? It can sting.

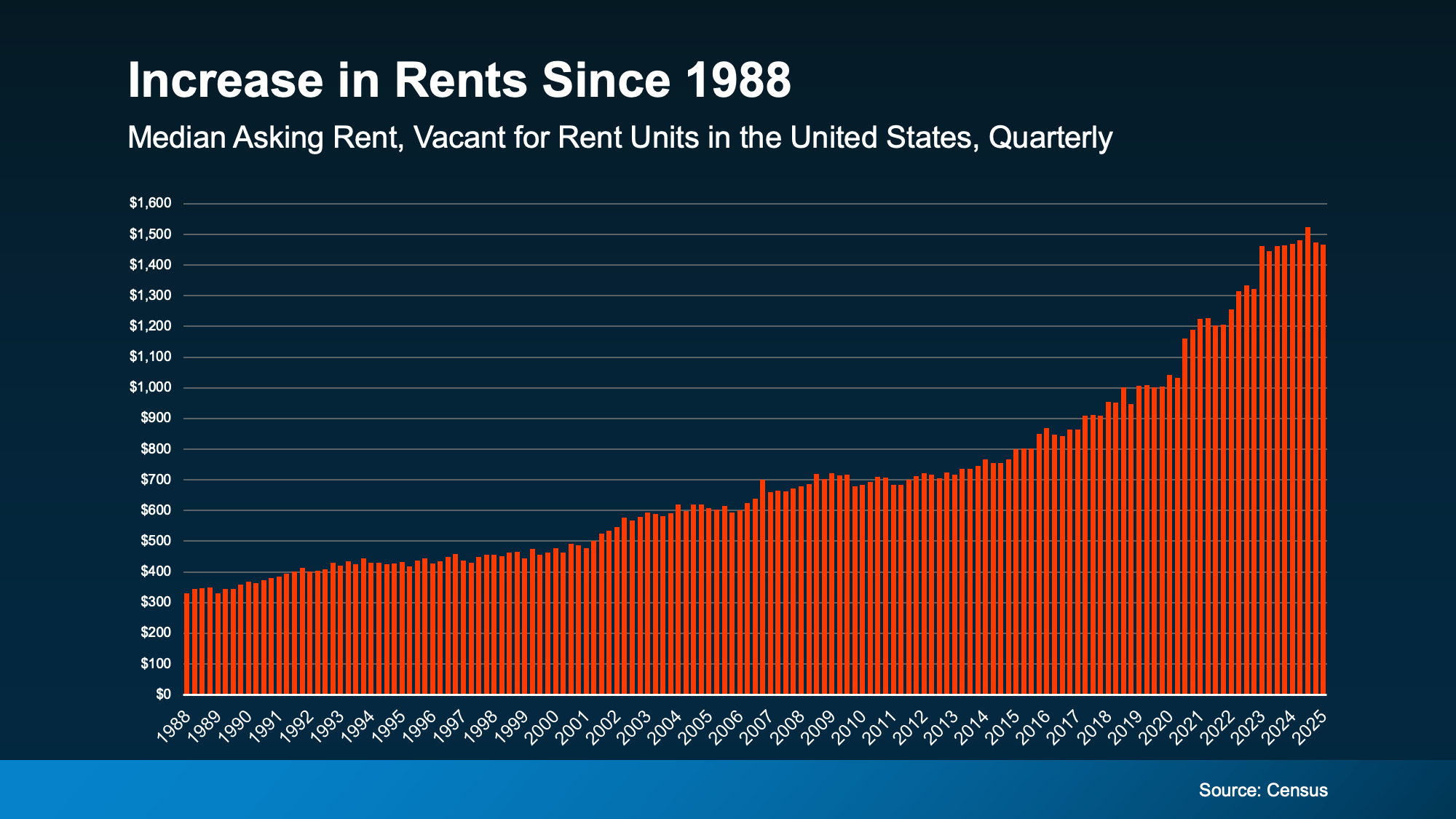

For decades, while home prices have been rising, rent has gone up too. And while rent has held rather steady more recently, history shows the overall trend is up and to the right. That makes saving for a home more complicated than ever (see graph below):

That kind of financial uncertainty has a real impact. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

That kind of financial uncertainty has a real impact. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

Because rent doesn’t build wealth. It doesn’t come back to you later. It pays your landlord’s mortgage – not yours.

So, whether you rent or own, you’re paying a mortgage. The question is: whose mortgage do you want to pay?

Think of it this way. Renting means your money is gone once you pay it. Owning means your payment builds equity – like a savings account you can live in. Sure, buying comes with responsibility. But it also comes with the kind of reward that grows over time. And that’s why you need a solid plan to get there.

As Joel Berner, Senior Economist at Realtor.com, explains:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Renting may feel more do-able today. But over time, it could cost you more – without helping you build anything for your future.

If homeownership feels out of reach today, you’re not alone. And the first step toward getting out of the rental trap is to set a plan. Let’s connect, set your specific goals, and explore your options – so you’re ready when the time is right.

Do You Need Flood Insurance?

Shifting your furniture may shift how you think, feel, and even behave. Clinical psychologists and interior designers explain why

Hidden Gem is the Color of the Year

I’d love to hear from you! Whether you’re buying, selling, or just exploring your options, I'm here to provide answers, insights, and the support you need. Contact me and start planning your next move.