What You Can Do When Mortgage Rates Are a Moving Target

Beth Helvey April 22, 2025

Beth Helvey April 22, 2025

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.

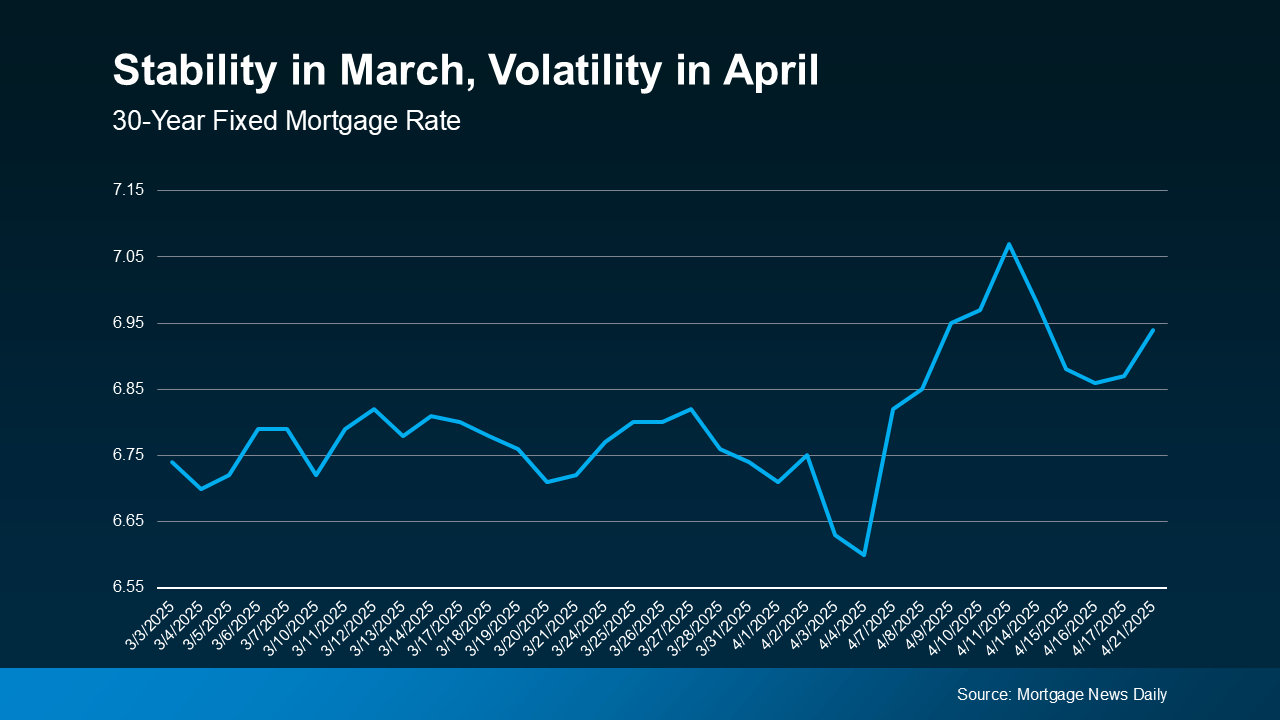

Take a look at the graph below. It uses data from Mortgage News Daily to show that after a relatively stable month of March, mortgage rates have been on a bit of a roller coaster ride in April:

This kind of up-and-down volatility is expected when economic changes are happening.

And that’s one of the reasons why trying to time the market isn’t your best move. You can’t control what happens with mortgage rates. But you’re not powerless. Even with all the economic uncertainty right now, there are things you can do.

You can control your credit score, loan type, and loan term. That way, you can get the best rate possible in today’s market.

Your credit score can really affect the mortgage rate you qualify for. Even a small change in your score can make a big difference in your monthly payment. Like Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Keeping your credit score up is key when it comes to qualifying for a home loan. If you’re not sure where your score stands or how to improve it, talk to a loan officer you trust.

There are also different types of loans out there, and each one comes with unique requirements for qualified buyers. The Consumer Financial Protection Bureau (CFPB) explains:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Always work with a mortgage professional to figure out which loan makes the most sense for you and your financial situation.

Just like there are different loan types, there are also different loan terms. Freddie Mac puts it like this:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most lenders typically offer 15, 20, or 30-year conventional loans. Be sure to ask your loan officer what’s best for you.

You can’t control what’s happening with the economy or mortgage rates, but you can work with a trusted lender and take steps that’ll help you get the best rate possible.

Let’s connect to talk about what you can do today to put yourself in a strong spot for when you’re ready to buy a home.

A rare opportunity to own a piece of Sarasota design history—fully updated for today’s lifestyle.

Explore the latest Sarasota real estate market trends for Feb 23 – March 1, 2026. See updates on pending sales, closed transactions, price changes, and buyer activity … Read more

How to Prep for a Mortgage Before You Fall in Love With a House

Freezing = anything that requires a jacket we forgot we owned

Market Report for January 5-11,2025

I’d love to hear from you! Whether you’re buying, selling, or just exploring your options, I'm here to provide answers, insights, and the support you need. Contact me and start planning your next move.